GB Auto and its subsidiaries (S.A.E.)

Notes to the consolidated financial statements For the financial Year ended December 31, 2014

(In the notes all amounts are shown in Thousand Egyptian Pounds unless otherwise stated)

Warranty

The Group provides warranty on its products and guarantees to either fix or replace the products that are not working prop-

erly, and the Group has estimated its warranty liability to be EGP 77 307 at the end of the year for expected warranty claims

in the light of management experience for repair and returns level in previous years.

The warranty provision includes a long term provision amounted to LE 64 753 (December 31, 2013: LE 25 876).

Other provisions

Other provisions are related to claims expected to be made by a third party in connection with the Group operations. The

information usually required by accounting standards is not disclosed because the management believes that to do so would

seriously prejudice the outcome of the negotiation with that third party. These provisions are reviewed by management ev-

ery year and adjusted based on latest developments, discussions and agreements with the third party.

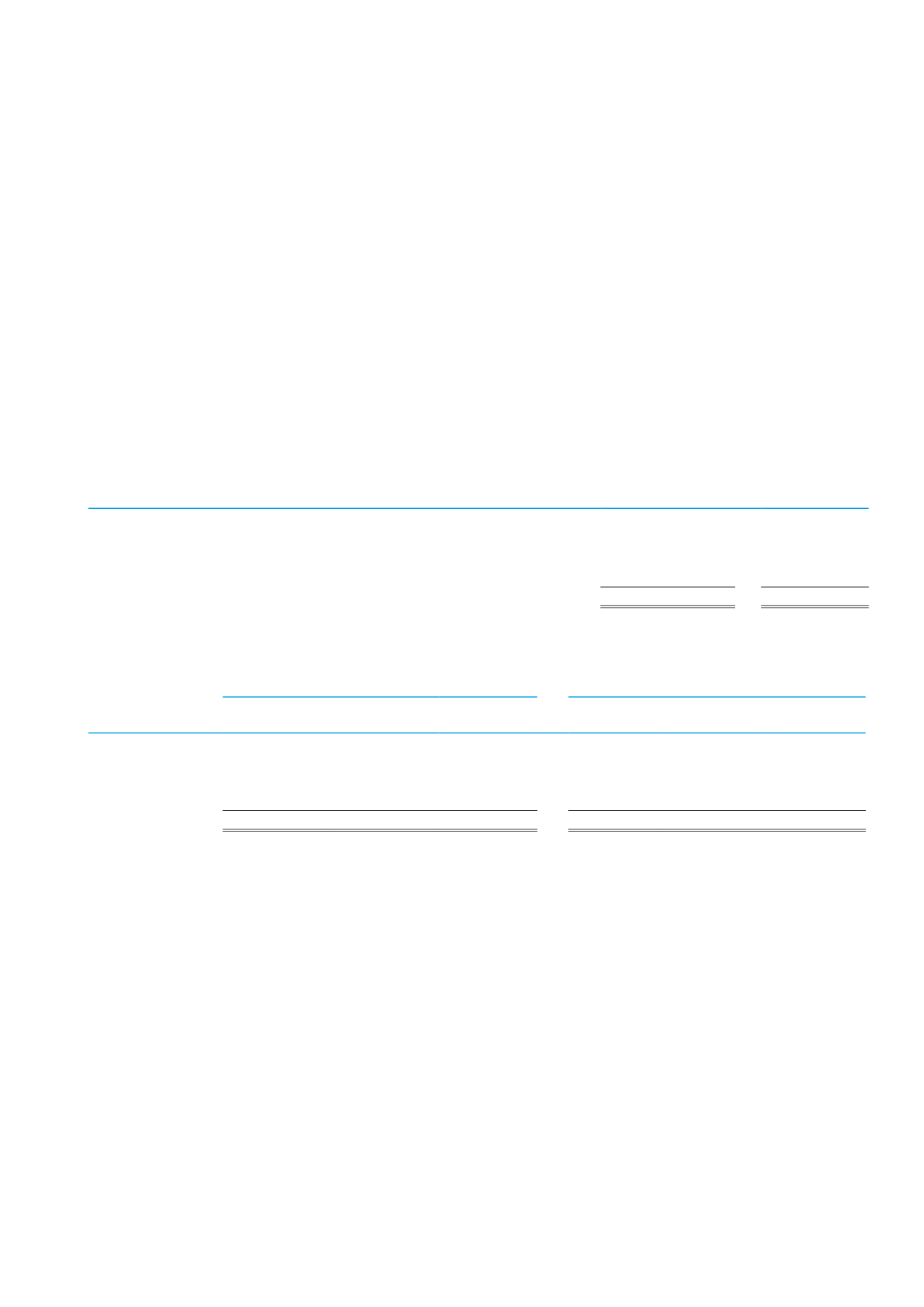

18. Current tax liabilities

December

31, 2014

December

31, 2013

Balance at 1 January

13 421

5 698

Taxes paid during the year

(22 307)

(9 192)

Income tax during the year (Note 32)

85 828

20 259

Withholding tax

-

(3 344)

Balance at the end of the year

76 942

13 421

19. Loans, borrowings and Banks overdraft

December 31, 2014

December 31, 2014

Current portion

Long-term

portion

Total

Current

portion

Long-term

portion

Total

Banks overdraft

3 246 050

-

3 246 050

2 627 186

-

2 627 186

Loans

331 567

656 140

987 707

162 655

217 012

379 667

Related parties

loans

567 221

24 713

591 934

-

-

-

Total

4 144 838

680 853 4 825 691

2 789 841

217 012

3 006 853

A. Banks overdraft

The average interest rate on the Egyptian Pounds and the US Dollars bank overdraft are 11.82% and 3.5% respectively.

B. Loans

Loans are represented in the following:

• Bank loans are secured by post dated checks that have been received from the customers. The average interest rates

are 4.21% for the loans dominated in US Dollars and 11.92% for the loans in Egyptian pounds. The maturity dates falls

within 5 to 7 years, to be settled within 2013 to 2019. The balance of the loans amounted to EGP 783 753 as at Decem-

ber 31, 2014.

C. Loans from related parties

• The Group obtained a loan from Marco Polo [a related party - Brazil] in US dollars with an interest rate of LIBOR + 3%.

The loan balance amounted to EGP 76 208 as at December 31, 2014 and to be settled on an annual installments and the

last installment on September 2016.

• On June 2, 2014, the ordinary general assembly meeting agreed unanimously after abstention Dr. Raouf Kamal Hanna

Ghabbour from voting, upon signing 2 loan contracts from the main shareholder of the Company, and the loans con-

tracts were signed on 3 June 2014, the following is a summary of the important conditions for the contracts.

Ghabbour Auto | 2014 ANNUAL REPORT

73