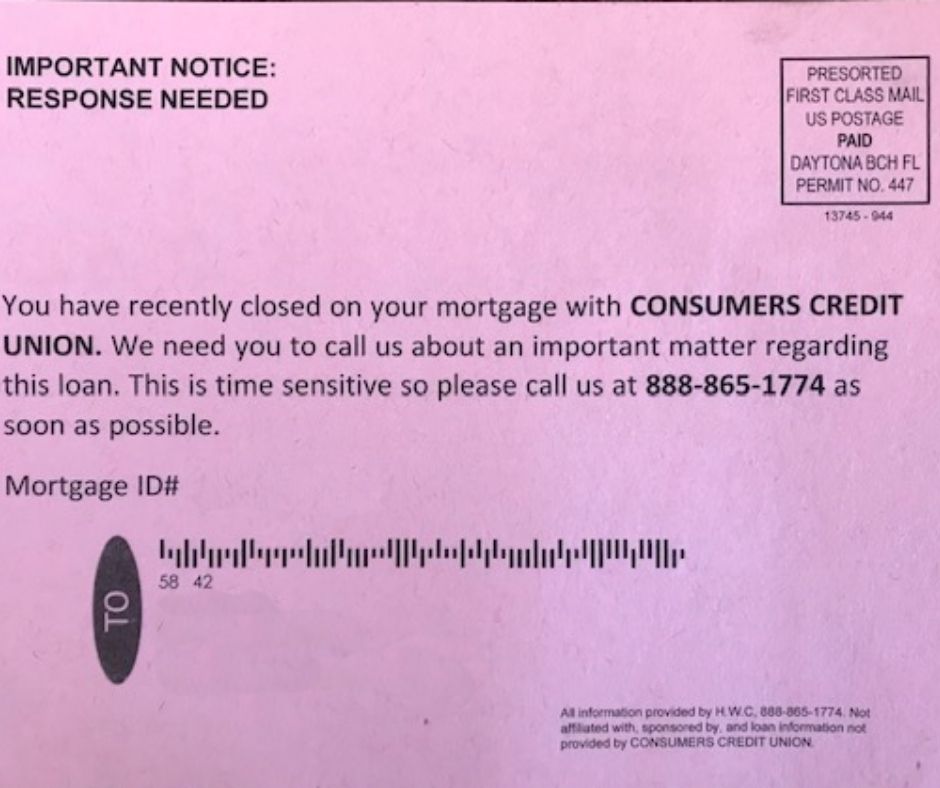

It might be shocking, but finding out who's recently purchased home is public information. Information on who bought or refinanced a home loan, the lender, the loan amount, and the address the loan is associated with is readily available at the courthouse. Companies will reach out to new homeowners at this time with offers like mortgage protection and life insurance.

In addition to making you aware of your need for life insurance, Mortgage Life policies can be a GOOD deal for some people. Please, read on to find out if you are one of those people for whom this product makes sense.