COVERAGE PLANS

At Complete Care, we know that when it comes to your home, you know best. That’s why we’ve created a variety of plans so you can choose what works for your home and your budget.

About Us

COVER THE REPAIR OF YOUR HOME SYSTEMS AND APPLIANCES

No age restrictions on systems & appliances

30 Years of Experience

Our impressive network of tried-and-true household service providers are the best in industry. We’ll get your repair work finished swiftly and efficiently– Satisfaction Guaranteed!

Unlimited Service Calls

Our qualified representatives are on call 24/7, 365 days a year. There is definitely no limit to the quantity of claims you can file.

Protection Guarantee

If ever your protected system or appliance can not be repaired, we’ll replace it.

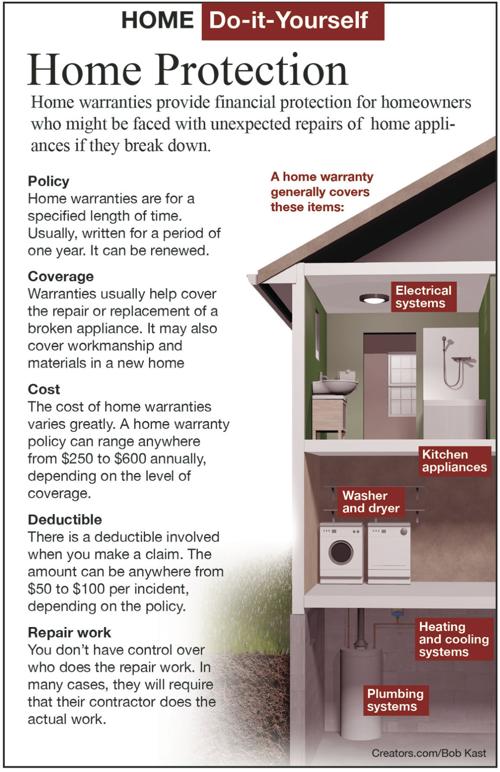

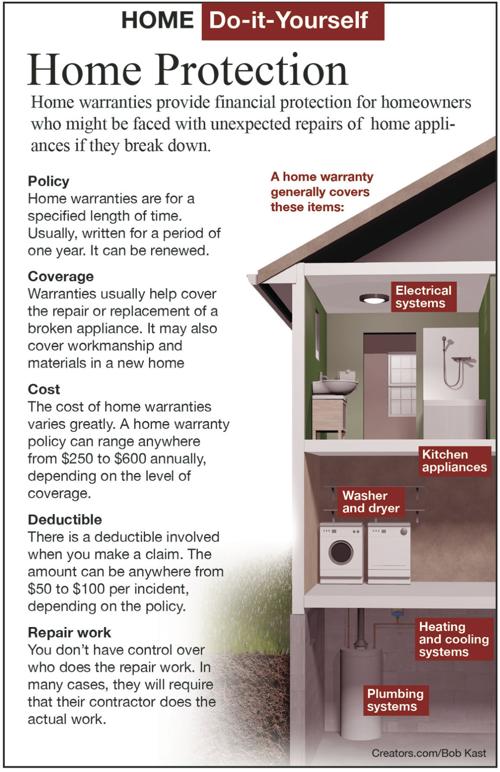

What is a home warranty?

A home warranty is a one year service contract, which helps protect homeowners against the cost of unexpected repair or replacement of major systems and appliances that break down due to normal wear and tear. Cover the repair of your home systems and appliances. No age restrictions on systems & appliances! 30-Day Risk Free Enrollment! Don’t wait until it’s too late fill out above form and get a FREE QUOTE on a home warranty.

Contact Us

Complete Care Home Warranty

1350 N Kolb Rd Tucson, AZ 85715

Telephone

+1 877-448-2871

Hours

Open 24 hours

We also provide Home Warranty services in the following cities

- what does a home warranty cost Three Points, AZ

- do I need home warranty Nariska, AZ

- compare home warranty companies Highjinks, AZ

- what does a home warranty cost Green Valley, AZ

- how home warranty works Robles Junction, AZ

- how home warranty works Green Valley, AZ

- assurant home warranty Naviska, AZ

- are home warranty required Marana, AZ

- home warranty process Corona de Tucson, AZ

- home warranty pricing Helvetia, AZ

- compare home warranty companies Three Points, AZ

- is home depot extended warranty worth it Dobson, AZ

- home warranty for buyers Diamond Bell Ranch, AZ

- home warranty pricing Avra Valley, AZ

- do home warranties cover roofs Corona de Tucson, AZ

- does home warranty cover plumbing Helvetia, AZ

- home warranty companies comparison Nariska, AZ

- are home warranties worth it? Naviska, AZ

- do I need home warranty Marana, AZ

- free home warranty Picture Rocks, AZ

More About Redington, AZ

The Facts About Are Home Warranties Worth The Cost? – Retirement Living Uncovered

House service warranties lessen repair work expenses, particularly when property owners insurance does not. Discover the pros and cons of purchasing a house warranty prior to or after closing. The difficult part is done: You have actually discovered your dream house. Now, after shelling out all that money for a deposit and other moving expenses, you may beware about spending a lot more money.

Purchasing a home is difficult, particularly if you’re a newbie purchaser. And the brief response is yes. It’s much better to consider having a house warranty in location quicker rather than later, though. Bear in mind that wariness about costs? Believe it or not, a house warranty actually helps you conserve money on inescapable repairs to those brand-new house systems and appliances.

Acquiring a home guarantee when buying a home is most likely one of the smartest investments you can make. Why? Since your house owner’s insurance just covers what could occur (like a fire or flood). A house service warranty, on the other hand, covers what will happen (like a device breakdown). As much as we would all love to think that a new-to-you home equals no future issues with its significant home appliances and systems, that’s just not sensible.

Some Known Factual Statements About When Can You Purchase A Home Warranty? – 2-10 Hbw

Your house can be covered by a service warranty anytime, whether you’ve lived in it for a few months or several years – how to find your home warranty. And your coverage choices must stay the exact same, also. Speaking of choices, the finest house guarantee companies will supply numerous of them, so you can customize a plan that fulfills your needs.

Desire to include on swimming pool and spa coverage? You can do that, too. Typically, house guarantees that are acquired prior to closing receive a lower rate. If you’re thinking about acquiring the service warranty beyond closing, that might mean that you might need to pay a somewhat greater premium for the protection.

What’s more crucial, though: investing a couple of hundred dollars securing your spending plan or being stuck with a big expense when a significant appliance breaks down in your brand-new home after you’ve currently invested so much money? Also, some (or all) of your devices might be covered already. is home depot extended warranty worth it. If your home is new or if you acquired brand new major devices and systems, they could still be under producers’ warranties.

The Facts About Faq – Home Warranty Coverage – Global Home Protection Uncovered

It’s essential to consider the age of your house and what the evaluation report explained. If you purchased an older house with older appliances and systems, for instance, home guarantee protection should be a no-brainer. Also, consider the expense of obtaining a house warranty after closing a couple of hundred dollars for a year of coverage versus the cost to replace a significant appliance.

And you’ll be needed to pay the service call cost plus potential additional fees. With a house service warranty, you’ll just pay your fixed service call fee (most likely much less than the business’s typical charge) for a covered service. Those savings really include up!Thinking about more safeguarding your investment? Have a look at American House Guard’s offered home warranty alternatives..

Prior to you buy a house service warranty, think about how comfy you are with the answers to these questions. 1. Do I currently have protection? As noted above, new-home devices might currently be covered. Even if your home appliances aren’t brand-new, they may still be under warranty if you made the purchase with a credit card.

A Biased View of When Is A Home Warranty Worth It? – Mortgageloan

For instance, numerous American Express cards amount to 24 months of coverage (to a maker’s warranty of 2 to 5 years) on products you purchase with it. 2. How much will this guarantee expense? The response depends on the kind of plan you buy and the company you select.

Rates may also vary depending upon where you live. The American House Shield site, for example, says a plan that covers most major devices runs about $480 every year for a home in main Ohio; one that also includes the home’s electrical and plumbing systems costs near to $600. By contrast, a house owner in Westchester, N.Y., might pay $900 to cover significant home appliances and $1,020 to consist of electrical and pipes.

If you have an issue with an appliance or system, even one that’s covered, you’ll have to make a copayment when the contractor can be found in to do the work. Those charges range from $60 to $125 depending upon the work that requires to be done, according to the plans we examined.

The Ultimate Guide To When Can You Purchase A Home Warranty? – 2-10 Hbw

Am I clear about what the service warranty covers? Hutt says that the majority of the problems that the BBB receives about house service warranties originate from the reality that consumers don’t understand the coverage their strategies provide. The takeaway: Make sure to read the terms and conditions carefully. When we took a look at house warranty strategies, we discovered that some policies will cover your refrigerator but not the icemaker that features it.

Rumored Buzz on Frequently Asked Home Warranty Questions

There might likewise be a pre-existing conditioneven if it wasn’t apparent to you when you bought the home warrantythat allows the supplier to reject protection of the item. 4. Will this plan repair work or change a damaged product? Many home warranties discuss that if a repair is considered too pricey, the provider might provide to replace the damaged product rather.

5. Are there limits on how much this plan will pay? There are, however they depend upon the sort of strategy you purchase and the supplier. Over a 12-month membership term, the strategy from America’s 1st Choice House Club, for instance, pays up to $2,000 to access, identify, fix, or replace each covered product.

What’s The Difference Between A Home Warranty Policy And A … Fundamentals Explained

Picture that a week after moving into your home, you switch on the air conditioning and it doesn’t work. Or your dishwashing machine suddenly quits or the heating system heads out in the dead of winter season. These hiccups can be stressful, troublesome and, above all, costly. Not precisely something a brand-new house owner wants to face after putting down a package to buy a house. Getting a home warranty, however, can assist reduce some of the financial problem new house owners face when a major home appliance or house system heads out.

Here’s a summary on what a house guarantee is, just how much it costs and if it deserves it. how to choose a home warranty. A home guarantee is not an insurance plan, but rather a service contract that pays the expense of repair or replacement of covered products, such as significant kitchen area home appliances, along with electrical, plumbing, heating and air conditioning systems.

The Ultimate Guide To Home Warranties Offer Buyers Protection. Just Don’t Forget …

Individually, house owners insurance coverage covers losses incurred if your home and valuables are damaged or lost due to fire, theft or other dangers.” The warranty is developed to cover items that are in satisfying, good-working condition upon tenancy, and then stop working due to normal wear and tear,” says Mike Sadler, vice president of operations at America’s Preferred Home Guarantee, based in Jackson, Michigan.

She likewise advises them to purchasers.” It depends upon what I hear my customers stating their potential discomfort point is,” Smith states. “What is their issue or heartache about a residential or commercial property? Somebody might say, ‘I love this house except it’s on personal systems, like a septic tank or a well, and I don’t want to deal with it if it breaks.'” The expense of a house warranty varies from $350 to $600 a year more if you desire improved protection for such things as washers and clothes dryers, swimming pools and septic systems.

Buying An Older House? Buy A Home Warranty, Too! – Howard … Things To Know Before You Buy

Without a house service warranty, you might invest hundreds or countless dollars repairing or changing significant devices or systems – how to get home warranty to replace air conditioner. If you do not have actually money set aside for these costs, a home service warranty can more than pay for itself. According to HomeAdvisor, here are the typical nationwide expenses to replace some major home systems: Central air conditioning conditioner: $5,467 Heating system: $4,286 Water heater: Tank $889 (40 to 50 gallon tank); Tankless $3,000 Device repair: $170 (most homeowners spend in between $104 and $237) If you’re buying a previously owned house, you might think about getting a home warranty from a trusted business, particularly if your house examination reveals that numerous of the house’s appliances and systems are nearing their life expectancy.

Home sellers may desire to consider offering a house guarantee to buyers to sweeten the offer. In case a significant home appliance all of a sudden stops working, it can be fixed or replaced at little cost, which a new buyer will value. Property buyers who purchase brand-new building and construction generally get some type of guarantee from the builder for the home’s materials and craftsmanship, consisting of plumbing, electrical, heating and cooling systems for one, 2 or up to ten years.

Some Known Facts About 21 Frequently Asked Questions About Home Warranty.

Simply put, it’s not beneficial to purchase a home warranty for a freshly constructed house since you’ll wind up with replicate coverage. Likewise, some credit cards offer extended service warranties on top of the manufacturer’s service warranty with new appliance purchases, so if you renovate your cooking area and pay for brand-new devices with a charge card, it might not make sense to purchase a house warranty for those home appliances.

Plus, if you’re brand-new to an area, it’s not likely you’ll have established relationships with local professionals or mechanics to aid with repairs. Your home guarantee business normally looks after finding and working with a relied on technician. Not all homeowners have the DIY skills to handle repairs by themselves, so having a house warranty to draw on alleviates that worry.

Our Are Home Warranties Worth The Cost? – Los Angeles Times Statements

It’s crucial to know what’s covered and what’s not (how to choose a home warranty). Check the protection plan to see the list of exemptions and to identify if you want to update your agreement. Some potential downsides: Home service warranty business impose dollar limits per repair work or each year. This can differ significantly, and usually, the sky is not the limit.