COVERAGE PLANS

At Complete Care, we know that when it comes to your home, you know best. That’s why we’ve created a variety of plans so you can choose what works for your home and your budget.

About Us

COVER THE REPAIR OF YOUR HOME SYSTEMS AND APPLIANCES

No age restrictions on systems & appliances

30 Years of Experience

Our impressive network of tried-and-true household service providers are the best in the business. We’ll have your maintenance and repairs finished swiftly and efficiently– Satisfaction Guaranteed!

Unlimited Service Calls

Our trained representatives are readily available 24/7, 365 days a year. There is definitely no limit to the quantity of claims you can file.

Protection Guarantee

On the occasion that your covered system or appliance can not be fixed, we’ll replace it.

What is a home warranty?

A home warranty is a one year service contract, which helps protect homeowners against the cost of unexpected repair or replacement of major systems and appliances that break down due to normal wear and tear. Cover the repair of your home systems and appliances. No age restrictions on systems & appliances! 30-Day Risk Free Enrollment! Don’t wait until it’s too late fill out above form and get a FREE QUOTE on a home warranty.

Contact Us

Complete Care Home Warranty

1230 River Bend Dr Dallas, TX 75247 USA

Telephone

+1 877-448-2871

Hours

Open 24 hours

We also provide Home Warranty services in the following cities

- cost of home warranty Duncanville, TX

- home buyers warranty Cedar Hill, TX

- secure home warranty Desoto, TX

- how much is a home warranty Sunnyvale, TX

- home owners warranty Duncanville, TX

- what do home warranties cover Grand Prairie, TX

- home warranty cost Carrollton, TX

- home warranty vs home insurance Rowlett, TX

- home warranty cost Coppell, TX

- what is a home warranty Garland, TX

- what is a home warranty Rowlett, TX

- is home warranty worth it Sunnyvale, TX

- home warranty companies Desoto, TX

- home warranty insurance Garland, TX

- home warranty programs Rowlett, TX

- home warranty plans Carrollton, TX

- what is a home warranty Cockrell Hill, TX

- best home warranty companies Sunnyvale, TX

- what does home warranty cover Addison, TX

- what is the best home warranty Farmers Branch, TX

More About Richardson, TX

Richardson is a principal city in Dallas and Collin counties in the U.S. state of Texas.[3] As of the 2019 American Community Survey, the city had a total population of 121,323.[1] Richardson is an affluent[4][5][6] inner suburb of Dallas. It is home to the University of Texas at Dallas and the Telecom Corridor, with a high concentration of telecommunications companies. More than 5,000 businesses have operations within Richardson’s 28 square miles (73 km2), including many of the world’s largest telecommunications and networking companies, such as AT&T, Verizon, Cisco Systems, Samsung, ZTE, MetroPCS, Texas Instruments, Qorvo, and Fujitsu.[7][8] Richardson’s largest employment base is provided by the insurance industry, with Blue Cross and Blue Shield of Texas’s headquarters, a regional hub for GEICO, regional offices for United Healthcare, and one of State Farm Insurance’s three national regional hubs located in the community.[9]

Settlers from Kentucky and Tennessee came to the Richardson area in the 1840s. Through the 1850s the settlement was located around the present-day site of Richland College. After the Civil War a railroad was built northwest of the original settlement, shifting the village’s center closer to the railroad. Richardson was chartered in 1873, and the town was named after the secretary of the Houston & Texas Central Railroad, Alfred S. Richardson.

In 1908, the Texas Electric Railway an electric railway known as the Interurban, connected Richardson to Denison, Waco, Corsicana and Dallas. In 1910 the population was approximately 600. A red brick schoolhouse was built in 1914 and is now the administrative office for the Richardson Independent School District. In 1924 the Red Brick Road, the present-day Greenville Avenue, was completed. The completion of the road brought increased traffic, population and property values. The town incorporated and elected a mayor in 1925. In 1940 the population was approximately 740.

After World War II the city experienced major increases in population, which stood at approximately 1,300 by 1950. Throughout the 1950s the city continued to see growth including the opening of the Collins Radio Richardson office, Central Expressway, a police department, shopping centers and many homes. Texas Instruments opened its offices in Dallas on the southern border of Richardson in 1956. This was followed by significant gains in land values, population and economic status. In the 1960s Richardson experienced additional growth including several new parks, facilities and the creation of the University of Texas at Dallas within the city limits. By 1972 the population was approximately 56,000. Residential growth continued through the 1970s and slowed in the 1980s. Commercial development increased throughout the 1980s. Richardson had a population of 74,840 according to the 1990 census. Population increases throughout the 1990s was primarily from development of the northeast part of the city. The city of Buckingham, after being completely surrounded by Richardson, was annexed into the city in 1996.

4 Easy Facts About Home Warranty 101 – First American Home Warranty Shown

A home warranty is an one-year service contract that covers the repair or replacement of some home system and appliances. Home guarantees are not insurance coverage, they are service agreements. These are contracts for the company to spend for the repair work, and perhaps replacement, of defined items in your house. House warranties most likely do not cover as much as you.

might believe they do. House guarantees can have restricted coverage, and might leave out cooking area appliances, hot water heater, pipes, heaters, and other major devices. Often consumers should make extra payments for coverage of such big-ticket items. Many house service warranties do not cover structural defects, well pumps, septic systems, or other home systems. The repair work that a house guarantee leaves out from protection are frequently more in-depth than what they in fact cover. It might just repair, instead of change, broken items. Many contracts limit replacements to a specific brand and do not enable you to utilize the professional of your choice. House service warranties can also include various other exclusions, such as repair work to problems brought on by wear and tear, natural catastrophes, producer problems.

, or failing to carry out manufacturers’ suggestions for upkeep. Home service warranties frequently do not deliver everything that those offering them might promise. what is the best home warranty. They have claim caps. For instance, you might only get$ 1,600 to replace a$ 12,000 boiler. There also might be a deductible( a quantity you should initially pay before the house service warranty company will pay your claim). This time delay could cost you cash or challenge. The delay likewise may lead you to discover your own contractor and pay out of pocket. Other business might charge you a service cost, typically$ 75.

A Biased View of Home Warranties Offer Buyers Protection. Just Don’t Forget …

or more, each time you require a repair work. You do not get to select your own specialist. The service warranty company might not ensure all of the work performed by its contractors. For circumstances, if a professional ruins the venting of your clothes dryer while fixing a gas leak in the clothes dryer, the guarantee business.

might not pay to fix the venting. Many of the repair work covered are not expensive and might cost less than the quantity you pay for the home guarantee. Arbitration may not be the very best online forum for fixing your problem. Business offer house service warranties since they know that, most of the time, they will make more on the guarantee than they will need to pay out. Prior to purchasing any house service warranty, you ought to do the following: Check out agreements thoroughly to make certain you understand what is covered and– more notably– what is not covered. Be careful of exaggerated claims, such as the claim that your guarantee is” extensive” or declares that guarantees are like insurance coverage. Contact friends and next-door neighbors to see if they have had any experience with the business. Contact the D.C. Workplace of the Attorney General Of The United States( 202-442-9828) or the Better Business Bureau to see if the house service warranty business has had problems lodged against it. When thinking about whether a house guarantee is a good financial fit, compare the age of each product covered by a house guarantee with the item’s typical life span. The International Association of Qualified Home Inspectors provides a valuable chart: https://www.nachi.org/life-expectancy.htm If you are thinking about acquiring a home guarantee, research study the business using sources such as:. I am not a financial advisor. The material on this site is for educational and educational functions only and should not be interpreted as expert monetary suggestions. Please speak with a certified monetary or tax advisor before making any choices based upon the info you see here. I might be compensated through 3rd party advertisers however our evaluations, comparisons, and articles are based on unbiased procedures and analysis. Picture by: American House ShieldAs a house owner, pricey repairs are most likely among your biggest concerns. So what if somebody told you that.

you could assist reduce those fears with the understanding that if something does break, it’s covered for one simple service charge? Sounds too great to be real? Well, it’s not. A home warranty is an one-year service contract that covers repairs and replacements of a lot of significant house appliances and system components due to failure, standard use and other problems that happen due to age. A house warranty will usually cover most significant parts of large house systems, such as your HVAC( central.

4 Simple Techniques For What Is A Home A Warranty? – Daveramsey.com

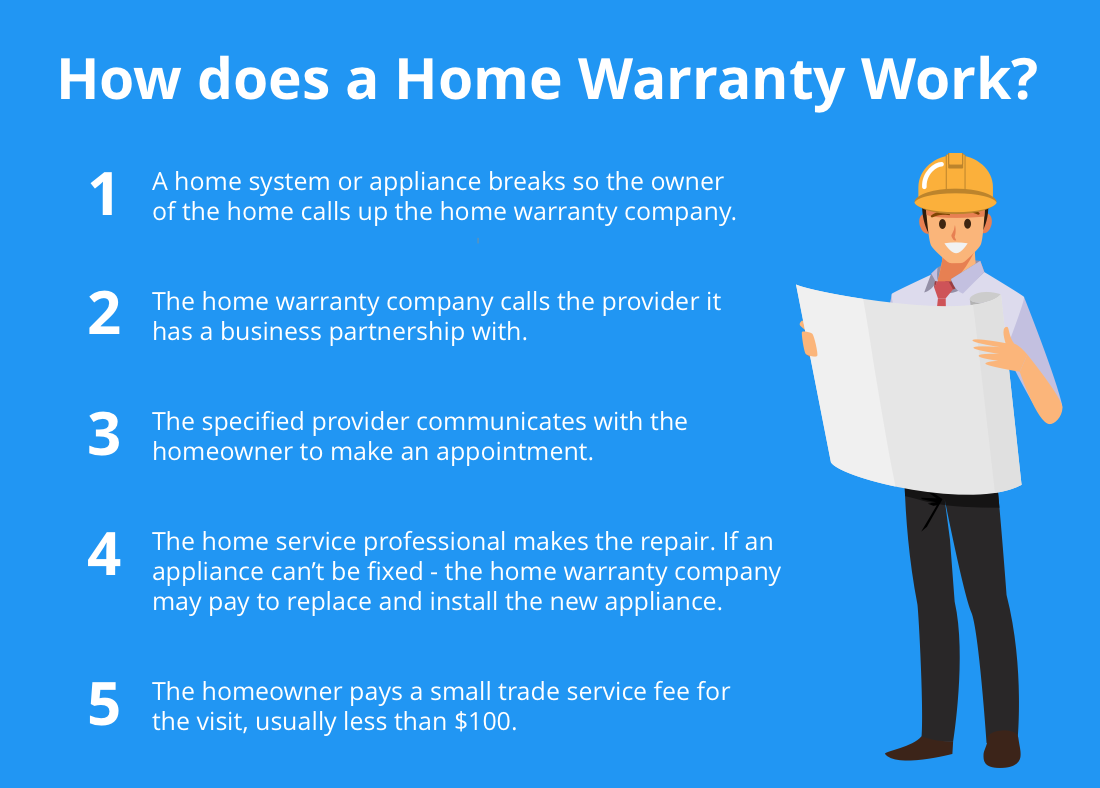

heating ventilation air condition), hot water heaters, plumbing, electrical and more. Some strategies enable you to buy optional add-on protection for your medspa, second refrigerator, swimming pool, pumps and more. When your home appliance or house system breaks down, call your house warranty business.

If the breakdown is covered by your plan, they will set up a consultation with a certified, pre-screened company in your location (home buyers warranty).

A Biased View of Frequently Asked Home Warranty Questions

The majority of home warranty terms are one year. This is a 12-month agreement which in lots of cases is renewable from year to year. Depending on your service provider and your place, house service warranties can run around$ 75 per month for a policy that consists of most major devices and house systems.

You can add on coverage for additional larger systems like swimming pools and day spas. It shows excellent faith and provides an assurance to purchasers that the house devices and significant parts of home systems are covered for the first year of ownership. If you currently have a home warranty, a typical policy can be moved to the new owner. Not only will a house guarantee safeguard your biggest financial investment, but it’s sure to assist you prepare for the unanticipated. While coverage differs depending upon the home guarantee business and the policy meanings, it is very important to understand that these policies are more like home service contracts that cover repair work and replacement of home appliances, equipment and other home functions must problems occur within the duration of protection. A house guarantee is not the like house owners insurance. Home warranty provides extremely particular protection for select appliances, equipment and other parts over a fixed duration defined by the terms of the policy. Home service warranty coverage might be extended, and warranty business, such as Choice Home Guarantee, normally send courtesy suggestions to property owners before completion date of the policy.

This kind of home warranty might consist of coverage for some structural components such as siding and stucco. At least for the very first year of protection, the majority of warranties for brand-new building would cover the expense of labor and materials on features such as doors, trim and paint. Elements of the heating, ventilation and cooling system along with the plumbing network may be covered for at least one year, as with Select Home Warranty. Select House Warranty With a resale house, the house seller may supply a house guarantee as part of a reward package to assure the purchaser that repairs and replacement of existing devices and equipment consisted ofin the house will be covered. The period of protection can range from one month to one year from the date of closing. For example, home guarantee protection for a washer and dryer set might benefit the first 3 months only, however the hot water heater may be covered for a year. Business such as AFC cover on a yearly basis. AFC House Club Homeowners may likewise opt to buy a home warranty policy from a 3rd party service provider as additional coverage. Check out the provider’s sample contractCompare house service warranty business & coverage plansMake a list of important systems & home appliances in your homeSee which plans cover those items & any possible stand-alone plansEstimate overall cost & compare plans Adam Morgan is a previous senior editor for Reviews.com. He’s composed about banking, credit cards, home warranties, insurance coverage, and many other topics (like running shoes) to give our readers the very best details to help in their purchasing decisions.

Is Using a House Guarantee to a Buyer Worth It? When purchasing something, most of the time there is a warranty that is used (home warranty coverage). Depending on the item that is being purchased, some warranties will be part of the makers guarantee and others will be service warranties that can be purchased by the customer.

The 25-Second Trick For Making Sense Of A Home Warranty – Column Capital

A longer “extended” service warranty is typically used for purchase as well and in these situations, it normally makes sense. How about when it comes to a home, are warranties worth it? Should a seller offer a home warranty to the buyer of their house? For the most part, the answer is yes! A home warranty can make a huge distinction in the sale of a home.

Selling a house can be a difficult time for lots of sellers. There are typically things that need to get done to prepare a house to get it “market all set,”, and also prepare psychologically for the modification that is upcoming. This sounds demanding enough, right? How about the property owner whose heater stops working in the middle of the winter season while their home is listed! The included stress of having to purchase a brand name brand-new furnace, which can range from $2,000-$ 4,000, can have a homeowner in total panic mode.

So, rather of needing to pay out $2,000+ dollars, a seller might just have to pay a small “trade charge” or “deductible” of a $100.00, which is a huge difference! Home guarantees generally are reliable from the listing date and cover the seller for the listing period, normally as much as 365 days.

Every home warranty will offer the seller coverage on various products within a house – home warranties. Most of house service warranties cover the seller on the “significant parts” or “huge ticket products” of a home. This includes products such as the heating unit, electrical wiring, hot water heater, and breaker. These huge ticket items, like a heater discussed above, can cost a seller $1,000’s in replacement expenses must they need repair work or replacement.

What Does Is A Home Warranty Worth The Cost? – Lendingtree Do?

The most important marketing “tool” a representative must utilize is recommending a reasonable listing cost for their seller’s home! This is the most essential tool for a property representative since the price of a home does most of the marketing. If a home is overpriced, it will not offer, period! A great property agent need to identify a realistic listing price of a potential clients home by carrying out a thorough.

There are certainly many purchasers out there who do acquire one, prior to closing. A seller who provides a house warranty to the purchaser frequently is providing themselves a competitive benefit. If a buyer is thinking about two properties that are really similar in rate, condition, and place, a seller who is supplying a home warranty can often “tip the scale” in the favor of the house owner who is providing it! Statistically, homes for sale that provide a house service warranty sell in a shorter amount of time and for more money due to the fact that of it.

A property representative who does not discuss, suggest, and use a house guarantee is truly doing their seller an injustice as it can be a really helpful marketing tool when offering a house! House Service Warranties Offer Purchasers with Additional Comfort Buying a house can be a nerve racking time.